Paypal for small business

PayPal is an online payment system that enables individuals and businesses to send and receive money electronically. Paypal is very good alternative for small business. Here we will discussed about how effective paypal is for small business. It was founded in December 1998 by Max Levchin, Peter Thiel, and Luke Nosek. PayPal is headquartered in San Jose, California, and operates in more than 200 markets globally.

How old are PayPal

PayPal started as a company called Confinity, which was focused on developing security software for handheld devices. In 1999, the company launched a payment system called PayPal, which quickly gained popularity among eBay users. In 2002, eBay acquired PayPal for $1.5 billion, and PayPal became eBay’s preferred payment system. Since then, PayPal has expanded its services and partnered with various companies, including Mastercard and Visa.

How PayPal works?

- PayPal works by creating a virtual wallet that is linked to your bank account or credit/debit card. You can use the wallet to send and receive money, make online purchases, and pay bills. To use PayPal, you need to create an account and link it to your preferred payment method. Once you have funds in your PayPal account, you can use them to pay for goods and services or transfer them to your bank account.

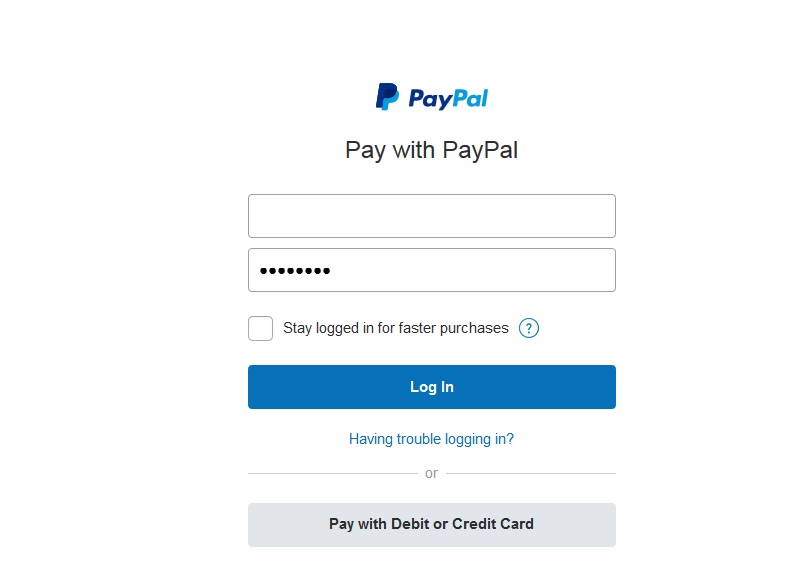

- ·Setting up a PayPal account To set up a PayPal account, you need to provide your name, email address, and create a password. You will also need to link your preferred payment method to your account. Once you have completed the registration process, you can start using PayPal to send and receive money.

- ·Different types of PayPal accounts PayPal offers different account types, including Personal, Premier, and Business accounts. Personal accounts are ideal for individuals who want to send and receive money for personal use. Premier accounts are suitable for people who sell products

Benefits of using PayPal for small businesses

In today’s fast-paced world, businesses need a reliable and secure payment method to handle their transactions. One such payment system that has gained widespread popularity is PayPal. PayPal is an online payment system that enables businesses to make and receive payments globally. PayPal has revolutionized the way small businesses conduct their transactions, offering a faster, safer, and more efficient method of payment. This article will discuss the benefits of using PayPal for small businesses.

1. Easy to Use:

PayPal is easy to use, even for those who are not tech-savvy. Setting up a PayPal account is simple, and once it’s done, businesses can easily send and receive payments with just a few clicks.

2. Global Acceptance:

PayPal is a widely accepted payment method around the world. This means that businesses can use PayPal to sell their products and services to customers in different countries, thus expanding their reach.

3. Fast Transactions:

PayPal transactions are processed instantly. Businesses do not have to wait for days for their payments to be processed, as is the case with traditional payment methods.

4. Secure:

PayPal is a secure payment method that uses the latest encryption technology to protect sensitive information. This gives businesses and their customers peace of mind knowing that their transactions are safe and secure.

5. Low Transaction Fees:

PayPal charges low transaction fees compared to other payment methods. This helps small businesses save money on transaction fees, which can add up over time.

6. Mobile Compatibility:

PayPal is mobile compatible, meaning that businesses can easily send and receive payments from their mobile devices. This is especially convenient for businesses that are always on the go.

7. Integration:

PayPal can be integrated into many different e-commerce platforms and software, making it easy for businesses to manage their transactions and payments from a central location.

8. Multiple Payment Options:

PayPal allows businesses to offer multiple payment options to their customers, including credit card payments, bank transfers, and PayPal balances. This helps to improve customer satisfaction and increases the likelihood of making a sale.

9. Protection for Buyers:

PayPal offers protection for buyers, which gives them peace of mind knowing that their transactions are secure. This helps to increase customer confidence and trust in a business.

10. Customizable:

PayPal allows businesses to customize their payment options and checkout pages, giving them more control over their customer’s experience.

11. Automatic Record-Keeping:

PayPal automatically keeps track of all transactions, making it easy for businesses to keep track of their finances and taxes.

Payment Reminders:

PayPal can send payment reminders to customers who have outstanding payments, helping businesses to get paid faster.

24/7 Customer Support:

PayPal offers 24/7 customer support, which is essential for businesses that operate globally and need support outside of regular business hours.

Faster Access to Funds:

With PayPal, businesses can access their funds faster than with traditional payment methods, as the funds are available almost immediately after a transaction is processed.

Competitive Advantage:

Using PayPal can give businesses a competitive advantage over those that do not offer it as a payment option. This can help to attract new customers and retain existing ones.

In conclusion, PayPal is a versatile and secure payment method that offers numerous benefits to small businesses. From easy setup and global acceptance to low transaction fees and automatic record-keeping, PayPal provides a convenient and efficient way for businesses to manage their transactions. With its customizable options, integration with e-commerce platforms, and 24/7 customer support, PayPal is an essential tool for any small business looking to grow and expand its reach.

How does PayPal help with international payments?

One of the biggest advantages of using PayPal is its ability to facilitate international payments. PayPal allows users to send and receive payments in multiple currencies, making it a valuable tool for businesses and individuals who need to make international transactions. PayPal’s international payment system is easy to use, with clear instructions and a user-friendly interface.

What are the benefits of using PayPal for international payments?

There are several benefits to using PayPal for international payments, including:

- Security: PayPal uses advanced encryption and fraud detection technology to keep your transactions secure.

- Convenience: PayPal makes it easy to send and receive payments from anywhere in the world.

- Speed: PayPal transactions are processed quickly, so you can get paid faster.

- Transparency: PayPal provides clear, itemized records of all transactions, making it easy to keep track of your payments.

- Low fees: PayPal’s fees for international payments are generally lower than those charged by banks and other payment systems.

PayPal for freelancers: How it can simplify payment processes

PayPal is a popular online payment system that has been around since 1998. It has become a trusted platform for